Elevated Stock Fund Volatility May Be Here To Stay

(But It's Not Necessarily A Bad Thing)

Twenty years ago, the Extended Market Index (all stocks not included in the S&P 500) was less volatile than the S&P 500 itself. Today they are 30% more volatile. What's changed?

In a word, technology disruption. Much as the NASDAQ index started out as a relatively boring small-cap index in the 1970s, and later morphed into a high-tech benchmark, the same transition is playing out in the broader mid-cap and small-cap universe. In place of slow-growing brick and mortar retailers, we now have high-flying biotechs pursuing gene therapy. In place of small-town banks, there are fast-growing payment processors and tech-services firms. In place of auto-parts chains, we have Tesla which dominates luxury electric vehicle sales and is challenging traditional automakers in the area of self-driving technology.

Collectively, the smaller stocks that make up the Extended Market are growing faster and taking on more debt, while pursuing business models that have potential to be much bigger and far more profitable than those in the past. All of these things contribute to increased volatility, but on a long-term basis the index is likely to see higher returns - much like the NASDAQ index has.

Effect On Actively-Managed Mutual Funds

For actively-managed mutual funds to be successful, they must be able to compete and win against the S&P 500. That either means holding stocks outside the S&P 500 universe or weighting companies or industries differently within the index itself.

Traditionally Fidelity has opted for the former. In the past there was little to lose by betting heavy on smaller stocks, because it reduced volatility while making it easier to outperform (provided you spent enough on stock research to know more than your competitors). But as the environment has changed, Fidelity's diversified funds have been relying less on smaller stocks and more on weighting differences within their benchmarks as a way to add alpha.

In some cases, such as the Enhanced Index funds, that approach has been successful, but in many cases it has not. Fidelity's large-cap blend funds, for example, have struggled to keep up with the S&P 500 over the past five years. And the disappointments within its diversified small-cap lineup have become so prevalent that we have taken to indexing in our non-sector portfolios that require small-cap exposure to enhance long-term growth.

Portfolio Implications

As technology disruptor firms increasingly dominate the stock market's capitalization in future years, volatility will likely rise among desirable actively-managed stock funds and passive funds that track smaller stocks. At the same time, long-term returns from those groups should rise in tandem (efficient market theory tells us that the market rewards investors in proportion to the risks they bear).

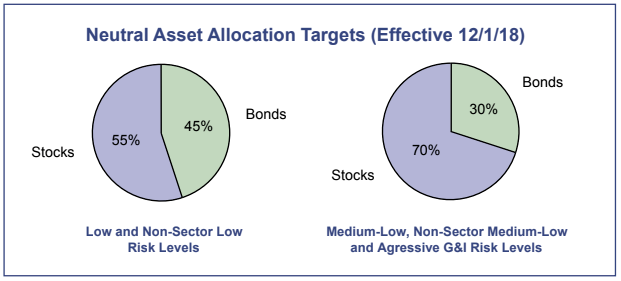

With this in mind, we've decided to shift the neutral weightings of our blended portfolios more toward bonds. This long-term move, which was implemented for most portfolios near the end of November, will make it easier to stay aligned with our portfolio risk targets (which remain unchanged). At the same time, it will provide more flexibility to invest in desirable segments of the stock market that might otherwise be off-limits due to their above-average volatility scores.

While it's possible that our new and slightly more conservative allocation targets will lead to lower long-term returns, odds are they won't, because we'll still be managing to the same risk targets. We expect that the additional return from a more growth-oriented mix of stock funds will offset any reduction in performance that results from the higher bond weightings.

So why make this move at all? If we didn't, the only way to meet our risk targets in an era of rising volatility would be to load up on low-volatility stock funds. In the past that worked pretty well because there were plenty of good opportunities in that space. But in today's tech-disrupted world, most "bargain" stocks are cheap for good reason, so when you buy a low-volatility stock fund the odds of being disappointed are relatively high. As such, we are simply adapting to evolving markets.

Reporting Statements Get A New Look

The portfolio tracking service we use has upgraded their software platform, and along with new capabilities comes a new look for our quarterly reporting statements. The pie chart on the summary page now shows aggregate stock/bond allocation for all portfolios under management, and the account-level breakdown page(s) now include a full list of portfolio holdings in most cases. In addition, account numbers are partially suppressed, providing greater security for mailed statements and the ability to identify accounts on emailed statements.

Fourth Quarter Review

Individual investors, driven mainly by fear, rushed to lock in profits throughout the fourth quarter. Like some past bear markets that occurred without any obvious deterioration in fundamentals or the economy (such as the period that included the 1987 Crash), the selling activity seemed more about preserving existing gains and booking tax losses than discounting less attractive fundamentals.

But even so, there was still plenty of panic to feed the selling frenzy. The reasons were many. Tariffs on trade with China, an overly hawkish Fed, Brexit, plunging oil prices, a yield curve on the verge of inversion, and the government shutdown. Individually, none of these threats seemed likely to have a large impact on either the economy or corporate earnings. But collectively they loomed large enough in some investors’ minds that selling was the only path to relief (and a good night’s sleep).

For the quarter, the S&P 500 fell 13.5%, finishing off 4.4% for the year. Our stock portfolios performed worse, primarily due to weakness in smaller stocks (the Russell 2000 fell 20.2% and was down 11.0% for the year), but also because of reduced expectations for FANG stocks and other technology disruptors. After an initial wave of selling in October, we made some defensive adjustments in order to bring our models back in line with their volatility targets. For portfolios that included an allocation to bonds, these moves helped limit losses in December.

Investment-grade bonds, which had been under pressure for most of 2018, finally saw relief in December as stock investors decided that income-oriented securities weren’t such a bad bet after all. For the quarter the Barclay’s Aggregate Bond Index gained 1.6%, finishing the year at breakeven. The bond side of our portfolios lagged because of exposure to high-yield and emerging-market debt. While we upgraded the bond side to investment-grade corporate debt in November, we lacked exposure to the lower-yielding government securities that drove the Barclay’s index, so we ended up posting small losses for both the quarter and the year.

Outlook

Despite the stock market’s large decline in the fourth quarter, we see little risk of a recession in 2019, and it should come as no surprise if corporate earnings continue to climb throughout the year. Some of the things that have been worrying investors, such as tariffs and a yield curve on the verge of inverting, might matter more if the economy was still fragile (or if home values had not recovered). But today, the combination of full employment, rising wages, substantial home equity and falling oil prices should keep consumers spending.

Some pundits argue that an inverted yield curve will almost surely lead us into a recession, but their argument is weak. Past inversions often occurred at a time when the economy was far more prone to inflation, requiring the Fed to tighten aggressively whenever oil prices surged. Back in those days the economy was also heavily dependent on bank lending, so an inverted yield curve was bad news all around because it would also stifle bank lending. Today the economy is less prone to inflation because technology disruption is creating abundance out of scarcity, so if the yield curve inverts it should not be a deep inversion. And bank lending is not nearly as critical in facilitating GDP growth, because the economy has moved beyond brick and mortar, and because many of today’s business loans don’t even come from banks - they come from technology disruptors that fund their own loans and are not dependent on the yield curve. As for home-buying, builders are more constrained by the labor shortage than by a lack of banks willing to write mortgages, so here again things will probably not happen the way they did in the past.

So what is the most likely scenario for 2019? We think the removal of uncertainty during the first half of the year will set the stage for recovery over the balance of the year. Given that smaller stocks and technology disruptors were the most heavily punished by panic selling, it should come as no surprise if those groups lead the market in its recovery phase. For that reason we haven’t made any major changes in our stock fund positioning, which remains heavily tilted toward those two groups. The year ahead should also be better for bond investors, as lower oil prices should bring relief on the inflation front, giving the Fed both more time and more flexibility in normalizing monetary policy.

Jack Bowers

President & Chief Investment Officer

P.S. As always we appreciate your feedback. If there is anything we can do to improve your experience as a valued client we’d like to hear from you. In addition, we are accepting new clients this quarter. If you have a friend, colleague, or family member whom you think might benefit from our service please let us know.