Cash on the Sidelines Portends Bullish 2020s

Last month The Wall Street Journal analyzed data provided by Fidelity and concluded that a significant percentage of individual investors liquidated their entire stock portfolio between February and May, especially those aged 65 and up. While there have been many other past situations that prompted individuals to reduce their equity exposure, this year's "Coronavirus Liquidation" may be unique among market timing events. The amount of risk-reduction that occurred in a short period of time might be unprecedented.

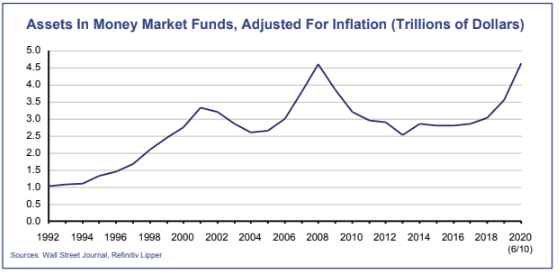

The chart on the next page tells the story. Assets in money market funds have surged this year, climbing by more than a trillion dollars in a matter of months. As of June 10, the inflation-adjusted amount of cash on the sidelines matches what happened after the Financial Crisis in 2008.

In effect, we have seen a massive transfer of stock from weak hands to strong hands. The strong hands are mostly corporate insiders and individuals with a high level of risk tolerance who have doubled down on stocks. Unlike the weak hands who sold, they recognize the temporary nature of the pandemic, and their investment horizon is at least three years out.

The strong hands are a "battle-hardened" group that is unlikely to react much to negative headlines. They know the economy will get back to normal one way or another. They expect the Fed’s determined effort to prevent avoidable bankruptcies will be largely successful. They are not concerned about rising P/E ratios because they know the indicator has little meaning in the current situation. They see stocks being cheap relative to potential 2022 earnings, and they expect interest rates to remain low for an extended period. For the most part they are ignoring the analysts, who seem largely clueless because most have lost their frame of reference.

Meanwhile the weak hands are sitting in cash earning next to nothing. They aren't happy about that, but until they see concrete signs that the world is getting back to normal, they don’t plan to budge. In that respect, their position is not much different than it was at the bottom of other major bear markets. Granted, a higher percentage of the weak hands may be resolving to stay in cash for the rest of their lives, but those kinds of vows tend to fade over time - just as New Year’s resolutions do.

This brings us to why lots of cash on the sidelines is a classic bullish indicator. In a scenario where the strong hands are not really interested in selling, the price of equities must move up significantly when those sitting on cash start to move some of it back into stocks. Typically this process plays out over a three- to five-year period. But this time around it might not take that long because success on the vaccine front would allow the global economy to see a relatively speedy recovery. And because today's cash-holders remain highly skeptical that a safe and effective vaccine will become available next year, the surprise factor could be rather intense if the promise of messenger RNA (mRNA) technology is fully realized.

Even if it isn’t, the world will eventually gain natural immunity, and for better or for worse the U.S. already has a head-start in that process. From an economic standpoint this means a new normal will eventually arrive. And with most bearish investors already in cash, it will probably happen without another major stock-market selloff.

Second Quarter Review

The economy shuddered back to life in the second quarter as states with lockdowns began to reopen in stages. While some areas that previously had relatively low coronavirus exposure are

now seeing a surge in new cases, so far most are finding that adequate hospital ICU capacity can be maintained with targeted measures such as closing bars and requiring face masks. The stock

market, seeing the Fed’s success in preventing avoidable bankruptcies, and encouraged by rapid improvement in employment and consumer spending, managed to recover most of its earlier

losses. For the second quarter the S&P 500 jumped 20.5%, for a year-to-date decline of 3.1%.

Massive fiscal and monetary stimulus measures set off alarm bells for some bond investors. But with falling energy prices and elevated unemployment levels, most have decided that rising prices won’t be much of a problem in the next 2-3 years. That allowed corporate bonds to rally on declining default risk. As a result, the Barclay’s U.S. Aggregate Bond Index gained 2.9% in the second quarter, finishing with a year-to-date return of 6.1%.

Our portfolios outperformed their benchmarks on both the stock side and the bond side, in most cases by a substantial margin. While we modestly rebalanced some equity positions by increasing our exposure to beaten-down value stocks, our overall stock exposure remained heavily tilted toward domestic growth - which was the strongest performing category for the quarter. On the bond side we maintained heavy exposure to corporates, which outperformed less risky, but more inflation-sensitive government debt.

Outlook

Despite record levels of new daily coronavirus infections, we don’t see the economic recovery getting derailed, though it might not turn out to be the "V-shaped" recovery that some are expecting. On the plus side, we now have reasonably effective ways to control the spread of the virus that don’t risk ruining the economy a second time, and in the hospitals we have better

methods of treatment (antivirals, blood thinners, clot-busters, steroids) that are likely to push the U.S. mortality rate down closer to that of the common flu.

The ultimate solution, of course, is an effective vaccine, and on that front things are looking quite promising. Messenger RNA technology has shown excellent results in early trials. And thanks to Covid-19’s slow mutation rate the immunity they provide is likely to last longer than that of inoculations for the common flu. In addition the manufacturing process used for making mRNA vaccines allows for scaling up to high volume in a very short timeframe. There are now several global drug-makers expecting to be in production in the next 12 months, with some looking to vaccinate medical workers late this year. The prospect of achieving herd immunity in the U.S. in the 2021-’22 timeframe is looking increasingly likely, potentially setting the stage for a full economic recovery within three years.

Of course, the stock market’s behavior between now and 2022 is still an open question. The corporate earnings picture remains foggy, and forecasts by analysts probably won’t be much help until we get closer to an economic normal. Some analysts are sounding the alarm over rising P/E ratios, but this "problem" is more due to shrinking earnings than rising prices. Many longterm investors still see stocks being cheap relative to earnings after a full recovery, especially with bankruptcies minimized and low interest rates persisting (likely scenarios in our view).

We are anticipating a shift in stock market leadership as confidence in the economy returns. Growth stocks today are generally trading at or above their pre-Covid levels, whereas value stocks have yet to make a full recovery. While we have somewhat lightened our overweighted position in growth stocks, we’re still looking to broaden our value exposure when the time is right - perhaps with more emphasis on active management. On the bond side, we continue to favor corporate issues. With interest rates most likely remaining low and stable for the balance of the year, we still think the best opportunities will be found in the high-yield segment, where an improving economy means lower default risk.

Sincerely,

Jack Bowers

President & Chief Investment Officer