S&P 500 Shareholder Compensation Takes A Dip

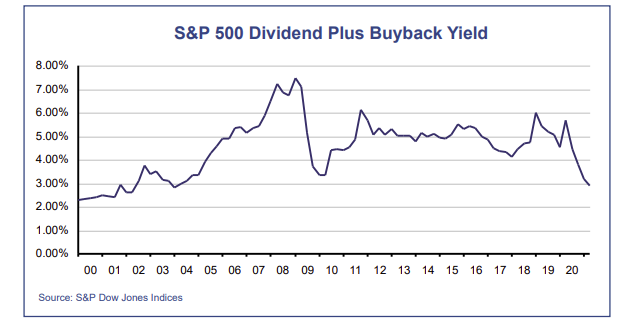

Pandemic-related dividend cuts, followed by rising stock prices, have caused the S&P 500 dividend yield to sink below 1.4% in recent months, putting it close to the historical low of 1.1% logged in summer 2000. On the plus side, a strong rebound in stock buyback activity over the last nine months could be an early sign that dividend increases will eventually follow, as it indicates that companies are now realizing they have far more cash than is necessary for operations. While that sets the stage for an increase in total shareholder compensation over the balance of the year, the current surge in buyback activity is not like those of the past.

This time around, it is coming almost entirely from growth companies in the technology, health care, and communications services groups, suggesting that these sectors may become the main source of dividends in the coming decade. The technology sector, which had a near-zero dividend yield two decades ago, now pays around 1% – not far below today's overall yield for the S&P 500. Still, it's a different situation when you have growth companies paying dividends. Because these firms typically deliver above-average earnings growth, they have less incentive to support their stock price through dividend increases. That could mean we'll see a lower rate of shareholder compensation for the S&P 500 in the future.

Expectations For Stocks In The Decade AheadFor the 10 years ending 6/30/21, the S&P 500's total return was 14.8% per year. Over that period, P/E expansion was responsible for about 6 percentage points of its return, and inflation accounted for about 2 percentage points. That means earnings growth and shareholder compensation contributed 7 percentage points – in-line with long-term averages.

What might we expect for the next 10 years? The pandemic triggered a surge in baby boomer retirements, so we'll likely be running with a smaller workforce and a higher rate of inflation until things get back in balance (which may take 2-3 years). While the year-over-year CPI rate could climb as high as 5-6% between now and mid-2023, a reasonable inflation assumption for the next 10 years would be 3%, which is slightly higher than the bond market's current 10-year breakeven expectation of 2.25% per year. Earnings growth may run at a higher rate as well, because the economy's transition from laborheavy businesses to labor-efficient technology disruptors could occur at a faster rate.

Circling back to shareholder compensation, it may settle out at a lower level as historical dividend payers (energy, utilities, financials) become a smaller slice of the S&P 500 pie. My best guess is that increases in earnings growth and declines in shareholder compensation will roughly offset, with stocks continuing to deliver a real returns of 7 percentage points per year. The bigger concern is P/E shrinkage. If interest rates rise, today's operating P/E of 27 could shrink to around 20, more in line with long-term averages in recent decades. That would imply an annual performance drag of three percentage points per year when applied over 10 years.

Putting it all together, we have 7 percentage points of real return, minus three percentage points for P/E shrinkage, plus three percentage points for inflation. That nets a total return projection of 7% per year for the decade ahead. Not great, but much better than the decade following the Y2K Tech Bust (which resulted in slightly negative S&P 500 returns).

Second Quarter ReviewInflation was on investors' minds in the second quarter, as rising energy costs and supply chain shortages collided with consumers' insatiable appetite for autos, homes, and home furnishings. The Fed initially brushed off concerns by saying that pricing pressures were transitory, but later telegraphed revised plans for boosting short-term interest rates in late 2022. Aside from a few volatile profit-taking days, the market handled the news well, thanks to upward earnings revisions and because most mandated pandemic restrictions were eased on the growing success of the U.S. vaccination effort.

After heavily favoring value and small-cap issues in the first quarter, investors were more interested in growth stocks during the second quarter. Contributing factors included profit-taking in value and small-caps, the Fed's hawkish shift, an improved outlook for growth-stock earnings, and concern that the Delta coronavirus variant might delay re-opening plans. But it was still a bullish quarter overall, with the S&P 500 climbing 8.5% for the three-month period, bringing its year-to-date return to 15.3%. Interestingly, the bond market's reaction to widespread price increases was modest, with 5-year and 10-year inflation expectations changing little, and long-term interest rates actually declining over the course of the quarter. The Barclay's U.S. Aggregate Bond Index gained 1.8%, cutting its year-to-date decline to 1.6%.

The stock side of our portfolios trailed the S&P 500 for the quarter. Part of the problem was that smaller stocks weakened as the yield curve flattened. But our increased emphasis on value stocks was also a significant detractor. The bond side of our portfolios ended up shy of the Barclay's Aggregate Bond Index as well, as our focus on funds with low interest-rate risk meant that we benefitted less as interest rates declined.

OutlookInflation could remain elevated for up to two years, possibly longer. Money supply growth, as measured by M2, is up about 25% since the pandemic took hold, and the U.S. workforce has shrunk due to accelerated baby-boomer retirements over the last 18 months. CPI readings of 5-6% on a yearover-year basis could occur regularly in what might be a relatively long adjustment period.

This could turn into bad news for bond investors, but if 10-year inflation expectations remain below 3%, and foreign demand for U.S. Treasuries remains strong, odds are the bond market will continue to take rising prices mostly in stride. As for stocks, increased pricing power is helping to boost earnings in some cases, and supply chain problems and labor shortages have been manageable (so far) in the sense that they are not having a negative impact on stock values.

The Delta coronavirus variant remains a significant concern for unvaccinated populations, but the hospitalization rate among the vaccinated is extremely low, so we don't think it will alter the progress that's being made in reopening borders to international travel and commerce in countries with high vaccination rates. It also seems unlikely to result in new pandemic restrictions in the U.S.

We continue to hold a mix of growth and value stocks, with a slight emphasis on the value side. Despite a slight headwind in the second quarter, we still think this is the right approach for the balance of the year. We are looking to become a bit less defensive on the bond side in our blended portfolios, but we may need to trim our stock weightings a bit in order to keep our volatility scores aligned closely with our targeted risk levels.

Sincerely,

Jack Bowers

President & Chief Investment Officer