Fidelity's Large-Cap Growth Funds Were The Rock Stars Of 2020. What Happens Next?

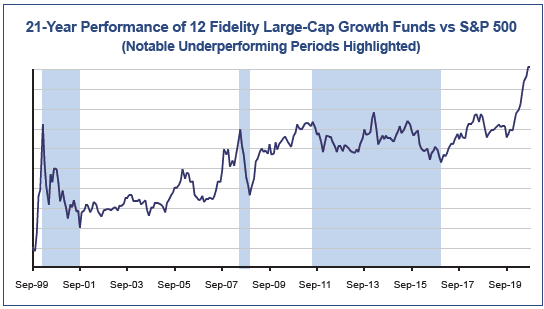

Fidelity's large-cap growth funds have long been the firm's unpredictable performance engines. Without them it would have been all but impossible to outperform the S&P 500 in recent decades. But holding them year in and year out hasn't been easy either, as evidenced by the post-Y2K tech bust, the 2008 Financial Crisis selloff, and the massive rotation into passive indexes that dominated the 2011-2017 period (see chart below).

This year's performance surge in the large-cap growth segment was a direct result of the pandemic, which gave a huge lift to the web-based economy. By some measures, several years worth of cloud-computing growth was realized in just a matter of a few months. That shift, along with the Fed driving the cost of capital down to very low levels, caused the value of profitable technology disruptors to skyrocket, much like it did in late-1999 and early-2000.

But unlike the post-Y2K period, today's leading technology disruptors are not facing an earnings drought. They are pricey because the market is putting a much bigger premium on future earnings, and with analysts operating largely in the dark, investors are deciding for themselves what things might look like by 2025. While this "collective wisdom" may seem overly-optimistic, it may actually be closer to the mark compared with the lofty period in late-1999. Case in point, today's “excessive” valuations are mainly reserved for tech disruptors that have a well-established record of profits.

Still, that doesn't insulate large-cap growth stocks from a potential pullback. The vaccine rollout could provide a path for GDP to reach a new high in 2021, prompting bargain-hunters to rotate into cheaper stocks that haven't fully recovered from the selloff in March. At the same time, today's relatively flat yield curve could become more upward-sloping, making bonds more attractive and stocks less so. Finally, there are likely to be at least some earnings disappointments among the major tech disruptors as consumer habits return

Put it all together, and it should come as no surprise if the large-cap growth segment underperforms in 2021, though it's hard to know the degree, or how long it will last. Plus there are some unpredictable factors. If the dollar continues to decline, some technology disruptors may be cushioned by an increase in value of their foreign earnings. But if foreign governments boost tax rates, or if regulatory efforts become more heavy-handed, it may add to the headwind.

Keep in mind that regardless of how the next 12-24 months play out, we're still in the golden age of technology disruption, as evidenced by a steady stream of IPOs and blank-check companies. Transportation disruption may be off to a shaky start, but still has potential to dramatically cut the cost of moving people and goods. In general, tech disruptors often beat traditional firms by a factor of 2-5 when it comes to labor-efficiency and rates of innovation. This usually means they consume a huge amount of capital to scale up to the point of profitability, but once they grow past that point their earnings can become very large.

As such, the long-term picture for Fidelity's large-cap growth funds could remain favorable. Today's tech disruptors span multiple industry groups, and account for perhaps 25% of total stock market capitalization. That number might become 50-75% over the next two decades. And if it does, the stage could be set for the above trend to continue.

Fourth Quarter Review

The stock market surged on favorable vaccine news in the fourth quarter, with smaller stocks and economically-sensitive issues seeing the strongest gains. For the most part, the market

shrugged off election uncertainty and Congressional delays in passing a second stimulus

package. And to a large degree it ignored a second round of targeted lockdown measures that

went into effect in places that struggled with hospital capacity constraints amid a surge of new

infections. The S&P 500 finished the fourth quarter with a gain of 12.1%, ending the year with

an increase of 18.4%.

Investment-grade bonds more or less marked time, with corporate bond funds registering small gains and government funds logging small declines as the yield curve grew slightly steeper. High-yield bonds, like stocks, climbed as investors realized the economy could fully recover by the end of 2021. The Barclay's U.S. Aggregate Bond Index returned 0.7% for the fourth quarter, finishing with a year-to-date increase of 7.5%.

Our stock portfolios benefitted from an unusually strong small-cap rally that pushed the Russell 2000 up 31.4% for the quarter, as well as from increased value-stock exposure. In most cases we outperformed the S&P 500 by a significant margin. On the bond side, our exposure to corporate bonds – especially in the high-yield segment – allowed the income-oriented portion of conservative accounts to finish ahead of the Barclay's index in most cases, with accounts that maintained high-yield bond exposure outperforming by a wide margin.

Outlook

With both of the leading mRNA vaccines approved for emergency use, and their providers

ramping up production to a level where 50% or more of the U.S. population could be inoculated

by June, the stage is now set for U.S. GDP to make a full recovery, perhaps even rising above

pre-pandemic levels by the end of 2021.

For stocks, this could mean significant gains on the value side of the style-box, but for growth stocks – most of which are priced optimistically – it's hard to know exactly what to expect. Some habits – such as working at the office, hopping on a plane for business travel, or routine shopping at brick & mortar stores – will be permanently altered. Others – such as leisure travel, live performances, and events – could see a surge as consumers elevate the priority of their bucketlist activities in the coming decade. Most likely, growth companies will continue to see earnings gains, but the rate of growth will slow significantly from 2020 levels.

On the bond side, the yield curve is likely to become more upward sloping, putting downward pressure on government bonds and possibly investment-grade corporates. But high-yield bonds still seem poised to benefit as credit-risk concerns subside in tandem with an improving economy.

Some investors still consider inflation a significant threat, but this is not the 1970s. Technology and innovation continue to create abundance out of scarcity. Savings rates have surged, and the large productivity gain that occurred in 2020 is not likely to be erased as everyone goes back to work. While there is a chance that inflation will rise above the Fed's long-term target of 2% in 2021, we don't see it as the most likely scenario.

As for portfolio strategy, we are entering 2021 with an equity allocation that is split almost equally between growth and value, with a slight bias toward smaller, more economicallysensitive stocks. On the bond side, we continue to favor investment-grade funds with shorter maturities, often in combination with higher-yielding corporates. In some cases, we are favoring mortgage securities because their negative correlation to stocks allows us to take on a little more risk on the equity side. Finally, it's worth noting that against a backdrop of many winners and losers, some actively managed funds may continue to enjoy a tailwind in 2021. As such, we'll be looking for ways to boost exposure to savvy stock-pickers – provided we can do so within the constraints of our volatility targets.

Sincerely,

Jack Bowers

President & Chief Investment Officer