Is Tax-Efficiency Largely A Myth?

Let’s start by summarizing tax reality. The more money your portfolio makes, the more taxes you will ultimately have to pay. You can pay it now, or you can pay it later. If you pay it later, tax rates may be higher than they are now.

While there are a few ways to be truly tax-efficient, limitations and tradeoffs loom large. The following are listed in descending order of potential usefulness:

- Contribute to a retirement account during your working years if possible. Traditional retirement plans allow you to start with pre-tax money and enjoy tax-free compounding, with taxes levied only when distributions occur. Roth accounts require after-tax contributions but do not get taxed again.

- Hold a low turnover index position (such as Total Market Index) in a taxable account for your entire life, with plans to have your heirs pay any estate taxes that come due (and hope there will be very little or none due).

- Offset income, retirement account distributions, and capital gains tax by donating highly-appreciated taxable holding(s) to Fidelity Charitable (or some other donor advised fund). This can make sense if you plan to make sizable grants to IRS-registered charities in future years.

- Invest in Municipal Bonds. Tax-free income sounds great, but these days yields are so low that the tax benefit is minuscule. Worse, durations for most state-specific funds are relatively high, meaning that even a small increase in interest rates could lead to significant capital losses.

- Obtain poor investment results – perhaps by attempting to time the market. You can laugh at this one, but remember it the next time you encounter a firm that is bragging about their tax-efficiency. It’s easy to keep taxes low when you have lots of losses available to harvest.

Apart from these options, tax-efficiency is more illusion than reality. Many promoters of passive vehicles (stock index funds and ETFs) talk up tax-efficiency, but what’s really going on is a delay tactic. By minimizing capital gain distributions, these vehicles allow an investor to build up a large unrealized gain over time, much like holding an individual stock. This keeps taxes low during the holding period, but you make up for it later when you sell the position. Once the gain is realized, the total taxes paid are much the same as an active vehicle (with the same total return) that distributed more long-term capital gains along the way (and therefore has less tax due upon sale).

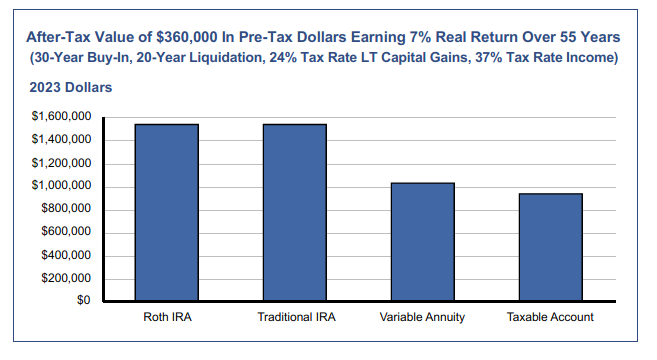

Then there’s the lure of tax-free compounding with variable annuities. Problem is, you’ve already paid taxes on the money once, and now you get to do it again on future gains – at full income rates upon withdrawal. The only way you can come out ahead is to invest aggressively and successfully over at least two decades (which is not how most annuities are positioned).

The chart above illustrates this at a typical state-plus-federal tax bracket. Traditional IRAs and Roth IRAs only get taxed once (Roth money is taxed up-front before contributions, Traditional IRAs are taxed upon withdrawal). Granted, a variable annuity account would have a bigger advantage if long-term capital gains were to be taxed at full income rates, but we are not there (at least not yet).

This brings us to perhaps the single most important thing you can do to maximize after-tax performance (provided you have both retirement accounts and taxable accounts): use your retirement accounts for more aggressive stock-oriented strategies, and use your taxable account(s) for more conservative lower-risk strategies where bonds and/or cash are part of the mix. This may seem counterintuitive to some investors, given the higher tax rate on income relative to long-term capital gains. But over the long run, stocks are likely to exceed inflation by 7 percentage points annually, whereas bonds may struggle to deliver a 2 percentage point advantage in the coming decades. Clearly, the tax burden created by bond-oriented investments will be substantially smaller than that of stocks, and bonds may create more opportunities for tax-loss harvesting as well. For those reasons, we think it’s better to use a taxable account for lower-return strategies.

First Quarter ReviewThere were a number of threats to the stock market’s continuing rally in the first quarter. The fate of a second stimulus package was unclear until it passed Congress. Hedge funds reduced equity exposure (both short and long) after a large group of individual traders forced a short-squeeze in GameStop’s stock. A big jump in long-term interest rates took a toll on bonds, triggering heavyhanded profit-taking in growth stocks.

Despite all that, value stocks kept marching forward – especially those of the mid-cap and small-cap variety – with analysts continuing to raise earnings forecasts as the pace of domestic vaccinations picked up (Pfizer in particular brought substantially more capacity on line in March). The bullish backdrop allowed the S&P 500 to post a gain of 6.2% for the quarter. Bonds, on the other hand, suffered a relatively severe rout as long-term yields surged back close to pre-pandemic levels. The Barclay’s U.S. Aggregate Bond Index declined 3.4% for the first quarter.

The stock side of our portfolios outperformed in most cases, thanks to a strong showing among active funds with small-stock exposure (the Russell 2000 was up 12.7% for the quarter). The bond side of our portfolios detracted, of course, but with a focus on high-yield and short-duration funds our losses were limited relative to the Barclay’s index. Overall, our portfolios generally performed well for the amount of risk they incurred.

Outlook

With Israel seeing a plunge in new daily Covid cases as the percentage of the population receiving

the first Covid shot surpassed 60%, the stage may be set for a similar outcome in the U.S. sometime

around the end of April. For that reason, we doubt the U.S. economic recovery will be derailed by a

new wave of infections, even with lockdowns being eased ahead of reaching that threshold.

Given that investors may have overreacted to the threat of inflation in the first quarter, and because Japanese banks are no longer under pressure to dump U.S. treasuries (they are past their fiscal yearend), the upward pressure on bond yields is likely to ease. We may still see rising yields in the second quarter, but the effect should not be as pronounced as it was in February and March.

As such, we can expect a stock market driven more by earnings and less by bets on growth or value. And because the playing field remains rich with winners and losers, active managers with good stockpicking skills are likely to continue enjoying a tailwind.

Our current approach involves holding a mix of growth and value stocks, with added emphasis on mid-caps and value stocks where risk targets allow. We’re continuing our defensive posture on the bond side by focusing mainly on short-duration funds, with emphasis on high-yield bonds in some blended accounts. We continue to favor active funds over index plays, though the latter is still useful for selectively adding mid-cap/small-cap exposure in some portfolios.

Finally, the U.S. economy seems likely to recover ahead of most foreign economies due to its relatively fast vaccine rollout. As a result, interest-rate differentials may strengthen the dollar while weighing on foreign stock performance. For these reasons, we favor domestic funds with foreign stock exposure (such as Low-Priced Stock) over direct bets on foreign funds.

Sincerely,

Jack Bowers

President & Chief Investment Officer