Wealth Effect Should Boost Consumer Spending in 2022

Estimates vary, but for each dollar of increased household net worth (mainly stocks and real estate), Americans tend to spend an additional 5 cents. For increased housing wealth, most of that tends to play out over the following 12 months. For increased stock market wealth, it’s more like 2-3 years.

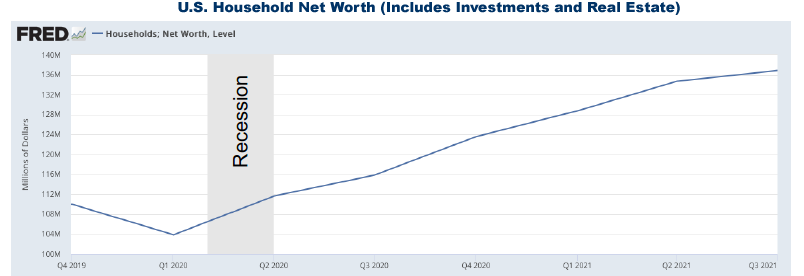

As shown in the chart on page 2, household net worth has gained at least $27 trillion during the pandemic, implying that consumers are in the process of spending an additional $1.4 trillion on remodeling, vehicles, furniture, leisure, travel, restaurants, and shopping. Assumming half of that happens in 2022, even with a 10% derating for inflation we may be looking at an increase in consumer spending of 6-7% this year. Throw in the effects of Congressional stimulus programs and it might even be higher.

Because consumer spending accounts for about 70% of GDP, we can expect GDP growth for 2022 to be in the 4-5% range – even if other components (business investment, government spending, net exports) remain flat. GDP is expressed in real terms, meaning it represents growth in excess of inflation.

Given this favorable economic backdrop, corporate earnings growth is expected to continue running above historical levels in 2022, though not at 2021’storrid pace (current forecasts call for S&P 500 earnings to increase 9%).

Stock Market ExpectationsFrom a forward P/E ratio standpoint, stocks became a bit less expensive during 2021, with the ratio declining from 22 to 21 as earnings grew faster than stock prices. Given the Fed’s plan for modestly increasing short-term interest rates, we can probably expect a slight decrease in forward P/E ratios once again in 2022. Earnings growth of 9% would likely accomplish that without any declinein stock values, so the key variable is actual earnings. If they are better than forecast (the most likely scenario), the S&P 500 could see a gain. If they are worse, the index could pull back.

The situation for active mutual funds may be more favorable. Mid-caps, small-caps, and foreign stocks are trading at lower multiples because their profit margins are not as robust. But as the economy moves toward a full re-opening, they may have more to gain than the mega-caps that dominate the S&P 500. Which means active mutual funds may have less downside risk and more upside potential compared to the market index.

Bond Market ImplicationsThe Wealth Effect has made consumers more tolerant of inflation, and a shortage of unskilled labor is boosting wage rates. In turn, these factors are giving the Fed leeway to favor economic growth over price stability. Knowing that inflation is likely to pull back on its own as supplychain issues are resolved, and that corporations have an array of automation options for dealing with rising wages, the Fed is going slow with respect to pushing up interest rates. Bonds arepriced about right for the Fed’s current rate-hike plan; they could pull back if the Fed is forced to become more hawkish, but they could also benefit if oil prices decline or if supply chain constraints resolve faster than anticipated.

The Fed’s relatively dovish response to surging inflation prompted investors to put their faith in the largest of the large-cap stocks in the fourth quarter. Mega-cap corporations have proven that they can maneuver around labor shortages and supply-chain constraints, and it is increasingly clear that they have enough pricing power to absorb cost increases without negatively impacting earnings.

Pulled up by mega-caps, the Samp;P 500 surged 11.0% in the final three months of the year to finish 2021 with a 28.7% return. It left other indexes (and most mutual funds) in the dust. The Russell 2000, which was held back by Omicron uncertainty, gained a meager 2.1% for the quarter and 14.8% for the year. The Barclay’s U.S. Aggregate Index finished the three-month period flat, ending the year with a 1.5% decline.

For our stock portfolios, 2021 was a disappointment, with results lagging the S&P 500 by as much as 11 percentage points. It was a sharp contrast to our 2020 performance, when those same portfolios outperformed by 12 percentage points or more. So far the pandemic has been a story of pricey stocks becoming ever more pricey, with many active mutual funds missing out. While some of this is rooted in changes to corporate earnings, valuation disparities have become wide enough that there are now good value plays even in growth industries. While we can understand why investors are chasing theS&P 500, it seems unlikely that the index will continue to outpace most other investment vehiclesin a post-pandemic economy.

OutlookInflation (and the Fed’s response to it) will likely be the biggest factor in the stock market’s performance for the coming year, but there are growing signs that today’s inflation scenario will not cause P/E ratios to tumble like they did in the 1970s. The Wealth Effect, along with significant wage gains in the unskilled labor segment, have made consumers more accepting of rising prices, giving corporations enough pricing power to pass along cost increases without negatively impacting their bottom lines. And while year-over-year inflation may keep rising in the first quarter – perhaps reaching double-digit levels – it will likely pull back and stabilize in the second quarter as supplychain issues are resolved. Wage inflation is likely to persist for an extended period, but thanks to a surge in automation and AI software spending, productivity improvements should help limit any long-term negative impact on corporate earnings.

Meanwhile, the Fed’s dovish response (three quarter-point rate hikes are anticipated for 2022) gives priority to economic growth over price stability. This makes sense because the long-term inflation picture looks benign in the face of an ongoing Chinese real estate bust and the electrification of transportation (which could eventually put downward pressure on oil prices). Collectively, bond investors see inflation running below 3% over the next decade, as evidenced by the Fed’s 10-year breakeven rate (an indicator derived from the yield on the 10-year Treasury and its TIPS equivalent).

The impact of the Omicron surge is likely to be relatively short-lived, as the variant spreads faster and appears to have a shorter recovery time compared with previous strains. By displacing Delta and getting the population closer to herd immunity, it may even bring us closer to the end of the pandemic. No surprise, some stocks that got a temporary lift from the pandemic are now beginning to reverse as investors anticipate a return to normal in 2022.

For 2022 we are looking for stocks to continue to follow earnings, which are likely to undergo some rotation but remain on a positive trend. As such we expect to maintain a relatively even balance between growth and value stocks in 2022. Bond-wise we will likely stick with our defensive position until inflation peaks.

New Home Office Location For 2022We are moving out of our Reno office and into a new location that is not far from Heavenly Ski Resort and South Lake Tahoe. The physical location is 1236 U.S. 50, Suite C, Glenbrook, NV89413. There is no postal service at that location, so our mailing address is P.O. Box 12578, Zephyr Cove, NV 89448. Office hours will continue to be by appointment.

Sincerely,

Jack Bowers

President & Chief Investment Officer